You Should

Expect :

- Fast Pre-Approval

- Competitive Interest Rates

- Flexible Loan Terms

- Help With Paperwork And Settlement

- Support For All Credit Types

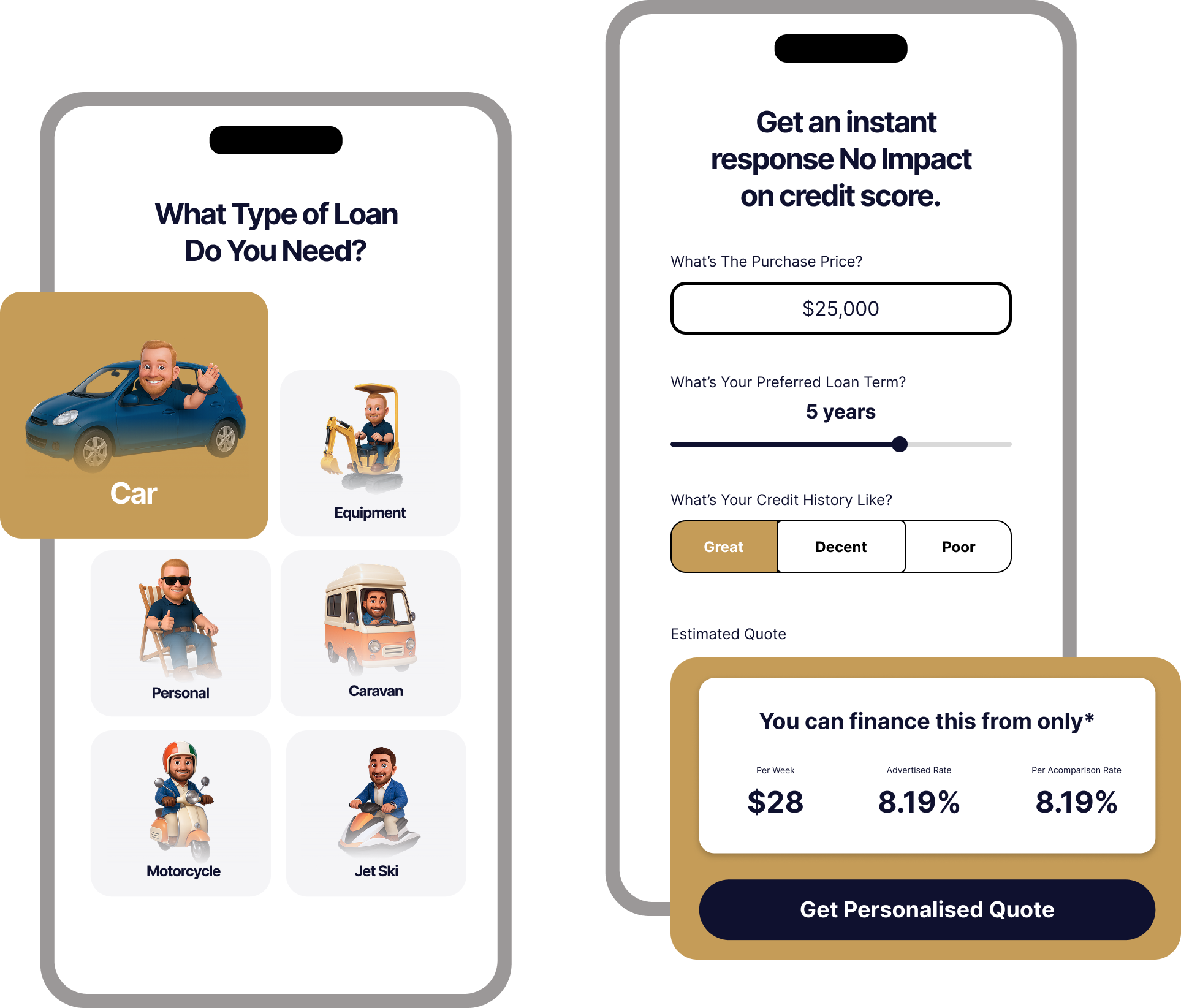

Easy to Control

Take control easily with just a few clicks

•Compare.

Enter your details into our AI-powered tool, and we’ll instantly show you the best loan options available.

The more information you provide, the more tailored and accurate your results will be

•Select.

Let our AI Options Tool get to work instantly! no more waiting!

Choose the best loan product from 30+ lenders and get your application underway.

•Apply.

Need more clarity? The platform gives you detailed insights to help you make the best choice.

Take control yourself online, or for a more personal touch let one of our broker’s assist you.

Secured or Unsecured

•Secured

A secured loan is backed by the asset being financed — for example, a car — which serves as collateral. The primary benefit of secured loans is their typically lower interest rates, as the collateral lowers the lender’s level of risk.

•Unsecured

In an unsecured loan, the lender does not require any asset to be held as security — there is no collateral. As a result, these loans typically come with higher interest rates compared to secured loans, due to the increased risk for the lender.

Unsecured loans are generally not the first choice for vehicle purchases, as using the car as collateral can often result in lower interest rates. However, there are situations where an unsecured loan may be suitable — for example, if the car being purchased is too old to be accepted by the lender, if it doesn’t meet the lender’s criteria, or if you need to borrow significantly more than the purchase price to cover additional costs or customisations.

Access to 30+ Lenders & More

Find My Lender Match

Got Any Questions?